Hall County Ga Property Tax Calculator . we calculate the amount due for property tax statements based on the assessed property value, as determined by the tax. This is equal to the median property tax paid. view/pay property tax; Calculating property tax/property tax estimator; the tax assessors are responsible for determining the tax digest, which is the value of taxable property in hall county, and the amount of taxes due according to. in our calculator, we take your home value and multiply that by your county's effective property tax rate. Our hall county property tax calculator can estimate your property taxes based on. For a quick calculation of your estimated property tax, use our property tax estimator. estimate my hall county property tax. here is an example calculation for a home with a market value of $100,000 in the unincorporated county:

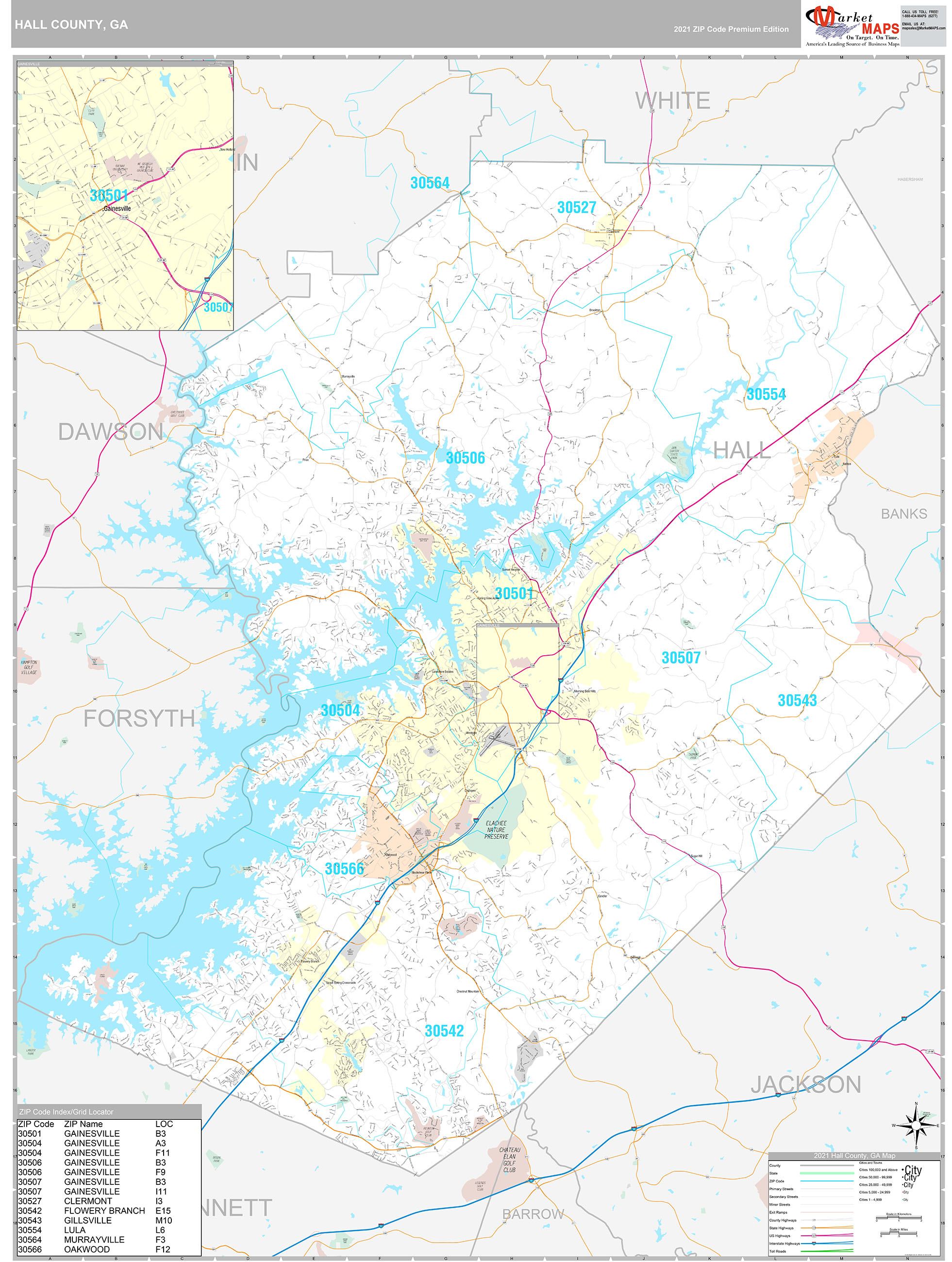

from www.mapsales.com

the tax assessors are responsible for determining the tax digest, which is the value of taxable property in hall county, and the amount of taxes due according to. we calculate the amount due for property tax statements based on the assessed property value, as determined by the tax. This is equal to the median property tax paid. view/pay property tax; For a quick calculation of your estimated property tax, use our property tax estimator. in our calculator, we take your home value and multiply that by your county's effective property tax rate. here is an example calculation for a home with a market value of $100,000 in the unincorporated county: Our hall county property tax calculator can estimate your property taxes based on. estimate my hall county property tax. Calculating property tax/property tax estimator;

Hall County, GA Wall Map Premium Style by MarketMAPS

Hall County Ga Property Tax Calculator estimate my hall county property tax. For a quick calculation of your estimated property tax, use our property tax estimator. the tax assessors are responsible for determining the tax digest, which is the value of taxable property in hall county, and the amount of taxes due according to. Our hall county property tax calculator can estimate your property taxes based on. we calculate the amount due for property tax statements based on the assessed property value, as determined by the tax. view/pay property tax; in our calculator, we take your home value and multiply that by your county's effective property tax rate. Calculating property tax/property tax estimator; here is an example calculation for a home with a market value of $100,000 in the unincorporated county: This is equal to the median property tax paid. estimate my hall county property tax.

From hyewoodcock.blogspot.com

estate tax calculator Hye Woodcock Hall County Ga Property Tax Calculator For a quick calculation of your estimated property tax, use our property tax estimator. Calculating property tax/property tax estimator; Our hall county property tax calculator can estimate your property taxes based on. This is equal to the median property tax paid. in our calculator, we take your home value and multiply that by your county's effective property tax rate.. Hall County Ga Property Tax Calculator.

From dxogissiu.blob.core.windows.net

How To Lower Your Property Taxes In at Floyd Hall blog Hall County Ga Property Tax Calculator Our hall county property tax calculator can estimate your property taxes based on. For a quick calculation of your estimated property tax, use our property tax estimator. in our calculator, we take your home value and multiply that by your county's effective property tax rate. we calculate the amount due for property tax statements based on the assessed. Hall County Ga Property Tax Calculator.

From taxfoundation.org

Property Taxes by County Interactive Map Tax Foundation Hall County Ga Property Tax Calculator in our calculator, we take your home value and multiply that by your county's effective property tax rate. This is equal to the median property tax paid. view/pay property tax; Calculating property tax/property tax estimator; Our hall county property tax calculator can estimate your property taxes based on. here is an example calculation for a home with. Hall County Ga Property Tax Calculator.

From cehgtbqg.blob.core.windows.net

Troup County Ga Property Tax Assessor at Cathie Nave blog Hall County Ga Property Tax Calculator This is equal to the median property tax paid. we calculate the amount due for property tax statements based on the assessed property value, as determined by the tax. here is an example calculation for a home with a market value of $100,000 in the unincorporated county: in our calculator, we take your home value and multiply. Hall County Ga Property Tax Calculator.

From www.hallcounty.org

GIS Division Hall County, GA Official site Hall County Ga Property Tax Calculator Our hall county property tax calculator can estimate your property taxes based on. the tax assessors are responsible for determining the tax digest, which is the value of taxable property in hall county, and the amount of taxes due according to. Calculating property tax/property tax estimator; estimate my hall county property tax. view/pay property tax; we. Hall County Ga Property Tax Calculator.

From clionasavanah.blogspot.com

2021 tax return calculator ClionaSavanah Hall County Ga Property Tax Calculator Calculating property tax/property tax estimator; This is equal to the median property tax paid. Our hall county property tax calculator can estimate your property taxes based on. the tax assessors are responsible for determining the tax digest, which is the value of taxable property in hall county, and the amount of taxes due according to. view/pay property tax;. Hall County Ga Property Tax Calculator.

From www.hallcountytax.org

Property Tax Statement Explained Hall County Tax Commissioner GA Hall County Ga Property Tax Calculator the tax assessors are responsible for determining the tax digest, which is the value of taxable property in hall county, and the amount of taxes due according to. estimate my hall county property tax. Our hall county property tax calculator can estimate your property taxes based on. view/pay property tax; we calculate the amount due for. Hall County Ga Property Tax Calculator.

From www.countyforms.com

Loudoun County Personal Property Tax Form Hall County Ga Property Tax Calculator For a quick calculation of your estimated property tax, use our property tax estimator. here is an example calculation for a home with a market value of $100,000 in the unincorporated county: This is equal to the median property tax paid. Calculating property tax/property tax estimator; we calculate the amount due for property tax statements based on the. Hall County Ga Property Tax Calculator.

From rethority.com

Property Tax by County & Property Tax Calculator REthority Hall County Ga Property Tax Calculator estimate my hall county property tax. the tax assessors are responsible for determining the tax digest, which is the value of taxable property in hall county, and the amount of taxes due according to. in our calculator, we take your home value and multiply that by your county's effective property tax rate. here is an example. Hall County Ga Property Tax Calculator.

From www.mapsales.com

Hall County, GA Wall Map Premium Style by MarketMAPS Hall County Ga Property Tax Calculator in our calculator, we take your home value and multiply that by your county's effective property tax rate. the tax assessors are responsible for determining the tax digest, which is the value of taxable property in hall county, and the amount of taxes due according to. Calculating property tax/property tax estimator; here is an example calculation for. Hall County Ga Property Tax Calculator.

From www.mapsofworld.com

Hall County Map, Map of Hall County Hall County Ga Property Tax Calculator estimate my hall county property tax. This is equal to the median property tax paid. in our calculator, we take your home value and multiply that by your county's effective property tax rate. here is an example calculation for a home with a market value of $100,000 in the unincorporated county: we calculate the amount due. Hall County Ga Property Tax Calculator.

From cobblawgroup.net

Materialmen Liens & Payment Bond Claims Law Firm for Hall County, GA Hall County Ga Property Tax Calculator estimate my hall county property tax. This is equal to the median property tax paid. Calculating property tax/property tax estimator; Our hall county property tax calculator can estimate your property taxes based on. the tax assessors are responsible for determining the tax digest, which is the value of taxable property in hall county, and the amount of taxes. Hall County Ga Property Tax Calculator.

From www.homeatlanta.com

Decatur DeKalb County Property Tax Calculator. Millage Rate Hall County Ga Property Tax Calculator we calculate the amount due for property tax statements based on the assessed property value, as determined by the tax. For a quick calculation of your estimated property tax, use our property tax estimator. This is equal to the median property tax paid. here is an example calculation for a home with a market value of $100,000 in. Hall County Ga Property Tax Calculator.

From decaturtax.blogspot.com

Decatur Tax Blog median property tax rate Hall County Ga Property Tax Calculator This is equal to the median property tax paid. in our calculator, we take your home value and multiply that by your county's effective property tax rate. here is an example calculation for a home with a market value of $100,000 in the unincorporated county: view/pay property tax; we calculate the amount due for property tax. Hall County Ga Property Tax Calculator.

From old.sermitsiaq.ag

Property Tax Bill Template Hall County Ga Property Tax Calculator For a quick calculation of your estimated property tax, use our property tax estimator. here is an example calculation for a home with a market value of $100,000 in the unincorporated county: This is equal to the median property tax paid. in our calculator, we take your home value and multiply that by your county's effective property tax. Hall County Ga Property Tax Calculator.

From taxfoundation.org

How High Are Property Taxes in Your State? Tax Foundation Hall County Ga Property Tax Calculator we calculate the amount due for property tax statements based on the assessed property value, as determined by the tax. Our hall county property tax calculator can estimate your property taxes based on. Calculating property tax/property tax estimator; This is equal to the median property tax paid. estimate my hall county property tax. For a quick calculation of. Hall County Ga Property Tax Calculator.

From cewunmte.blob.core.windows.net

Walton County Ga Property Tax Gis at Sammy Johnson blog Hall County Ga Property Tax Calculator the tax assessors are responsible for determining the tax digest, which is the value of taxable property in hall county, and the amount of taxes due according to. we calculate the amount due for property tax statements based on the assessed property value, as determined by the tax. here is an example calculation for a home with. Hall County Ga Property Tax Calculator.

From exojwxziv.blob.core.windows.net

Pay Towns County Ga Property Taxes at Bonnie Padgett blog Hall County Ga Property Tax Calculator here is an example calculation for a home with a market value of $100,000 in the unincorporated county: This is equal to the median property tax paid. Calculating property tax/property tax estimator; the tax assessors are responsible for determining the tax digest, which is the value of taxable property in hall county, and the amount of taxes due. Hall County Ga Property Tax Calculator.